- #Quickbooks payroll service unavailable how to#

- #Quickbooks payroll service unavailable full#

- #Quickbooks payroll service unavailable code#

- #Quickbooks payroll service unavailable plus#

These subscriptions will be available through the ProAdvisor Membership portal within QuickBooks Online Accountant.

#Quickbooks payroll service unavailable plus#

QuickBooks ProAdvisors will have access to the new QuickBooks Accountant Desktop Plus, Desktop Enterprise Accountant, and Desktop Mac Plus subscriptions around September 28, 2021. Extending availability of 2021 Desktop one-time purchase products until Dec.Introducing QuickBooks Desktop Mac Plus subscription.

Transitioning to subscription model for our Desktop lineup with the 2022 release.You are our valued partner, and we are reaching out to provide advance notice of QuickBooks Desktop 2022 product subscriptions and availability, ProAdvisor® pricing and support changes.įor our 2022 Desktop products, we are making 4 changes that we describe in detail below: On September 7, we sent the following email regarding the upcoming changes to our QuickBooks Desktop product lineup. Here is a little more info on reimbursing your employees directly through payroll.Editor’s note: Here’s a factsheet we’ve developed so you can talk with your clients about these changes.

#Quickbooks payroll service unavailable how to#

QBO has instructions on how to update your W -2 forms here. Remember, what goes on the W-2 for QSEHRA is the amount offered and not the amount claimed. Note, this will not actually cause the transfer of money to happen ("tracking only") but it'll automatically populate QSEHRA reimbursements on your employees' W2s at the end of the year.

#Quickbooks payroll service unavailable code#

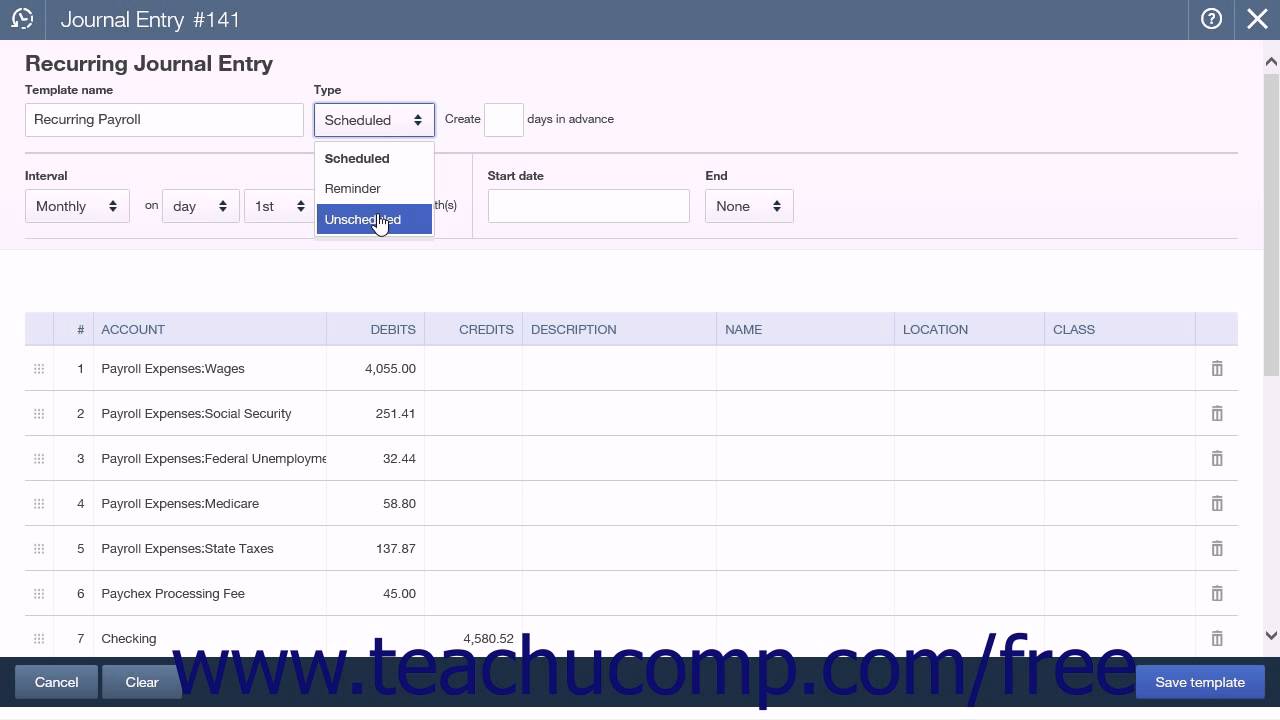

Quickbooks also has a unique tracking code for QSEHRA reimbursements. Give your other earnings pay type a name, like "QSEHRA Reimbursement," in case you add more than one other earnings pay type.Ĭlick Add other earnings type to add another pay type.

Select the Other Earnings checkbox, and enter a recurring amount (optional). Under How much do you pay the employee, click the pencil icon. In the left navigation bar, click Employees.Ĭlick the name of the employee you want to pay. To add the Other earnings pay type for an employee: You can add this by adding an "other earnings" type for each employee with taxable reimbursements. Taxable reimbursements are reported as income and taxed like regular Wages with income & payroll taxes withheld. Taxable reimbursements through QSEHRA include premiums paid pre-tax through a spouse's employer for a group plan can be reimbursed on a taxable basis alongside QSEHRA. While most reimbursements through QSEHRA are tax-free, there is one type of allowable reimbursement that must be taxed. After assigning the reimbursement to the employee, check your accounting preference to ensure it is posted in the correct accounts for exporting purposes. Once a reimbursement is added, you can also assign this to another employee. You can change the amounts each month if the reimbursement amount will not be fixed each month. Enter the reimbursement amount to add to the employee's paycheck. Next time you create a paycheck for the employee, the Reimbursement item appears in the Pay column. You can also rename this pay type to something like "QSEHRA Reimbursement" or "ICHRA Reimbursement" by selecting the pencil icon beside Reimbursement. You may enter a recurring amount in the box, or add it when you run payroll. Under How much do you pay, select Add additional pay types. Select Workers from the left menu, then select Employees.

#Quickbooks payroll service unavailable full#

QuickBooks Online Payroll and QuickBooks Online Payroll Full Service ( If using Intuit Full Service Payroll and this option is unavailable, contact Payroll Support for assistance.) You can also rename this pay type to something like "QSEHRA Reimbursement" or "ICHRA Reimbursement" by selecting Add/edit types > Add Reimbursement name. You may enter a recurring amount in the box, or add it when creating paycheck. Under What additional ways do you pay employee, select Show all pay types.

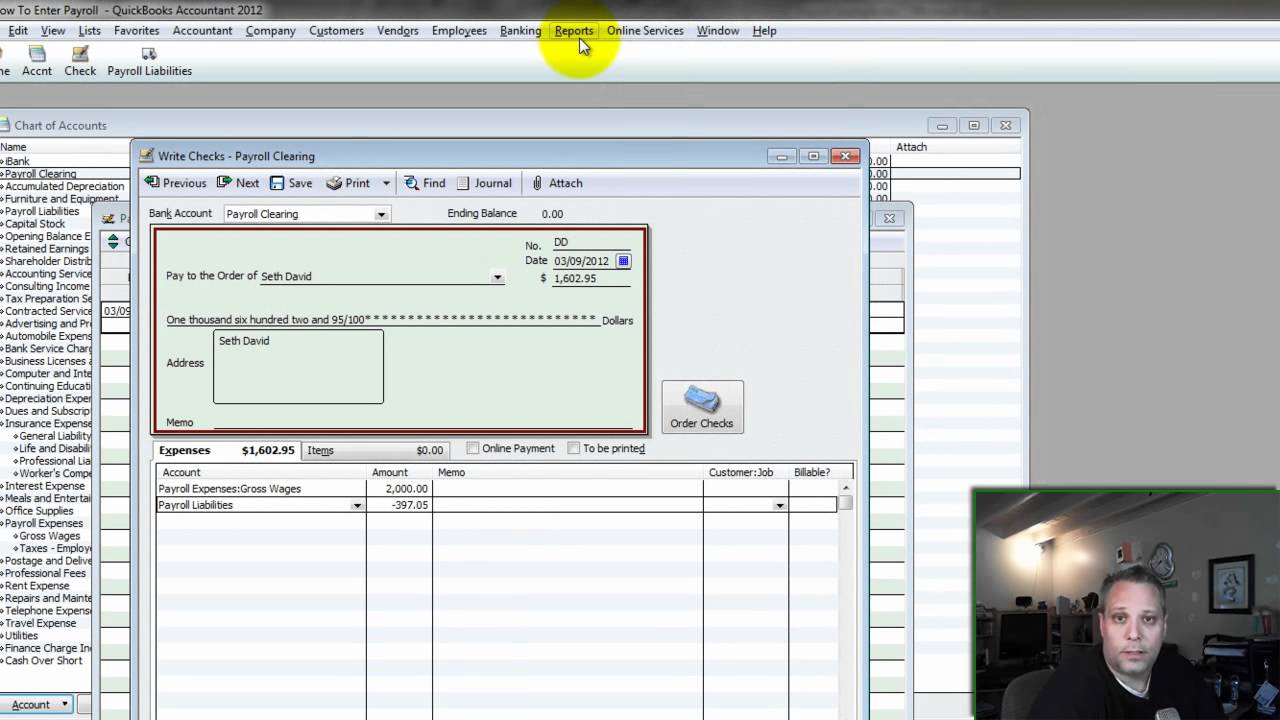

Select Employees, then select the employee's name. Intuit Online Payroll and Intuit Full Service Payroll Instructions for Quickbooks Desktop can be found here.īecause these payments aren't taxable, they don't appear on payroll tax or other tax reports. Note: These instructions are for Quickbooks Online Payroll.

0 kommentar(er)

0 kommentar(er)